Just How Offshore Investment Can Help You Secure Properties from Economic Instability

Wiki Article

How Offshore Investment Functions: A Step-by-Step Failure for Investors

Offshore financial investment provides a structured path for investors seeking to optimize their financial strategies while leveraging worldwide opportunities. The procedure begins with the careful option of a territory that aligns with an investor's goals, followed by the facility of an account with a qualified offshore establishment.

Understanding Offshore Financial Investment

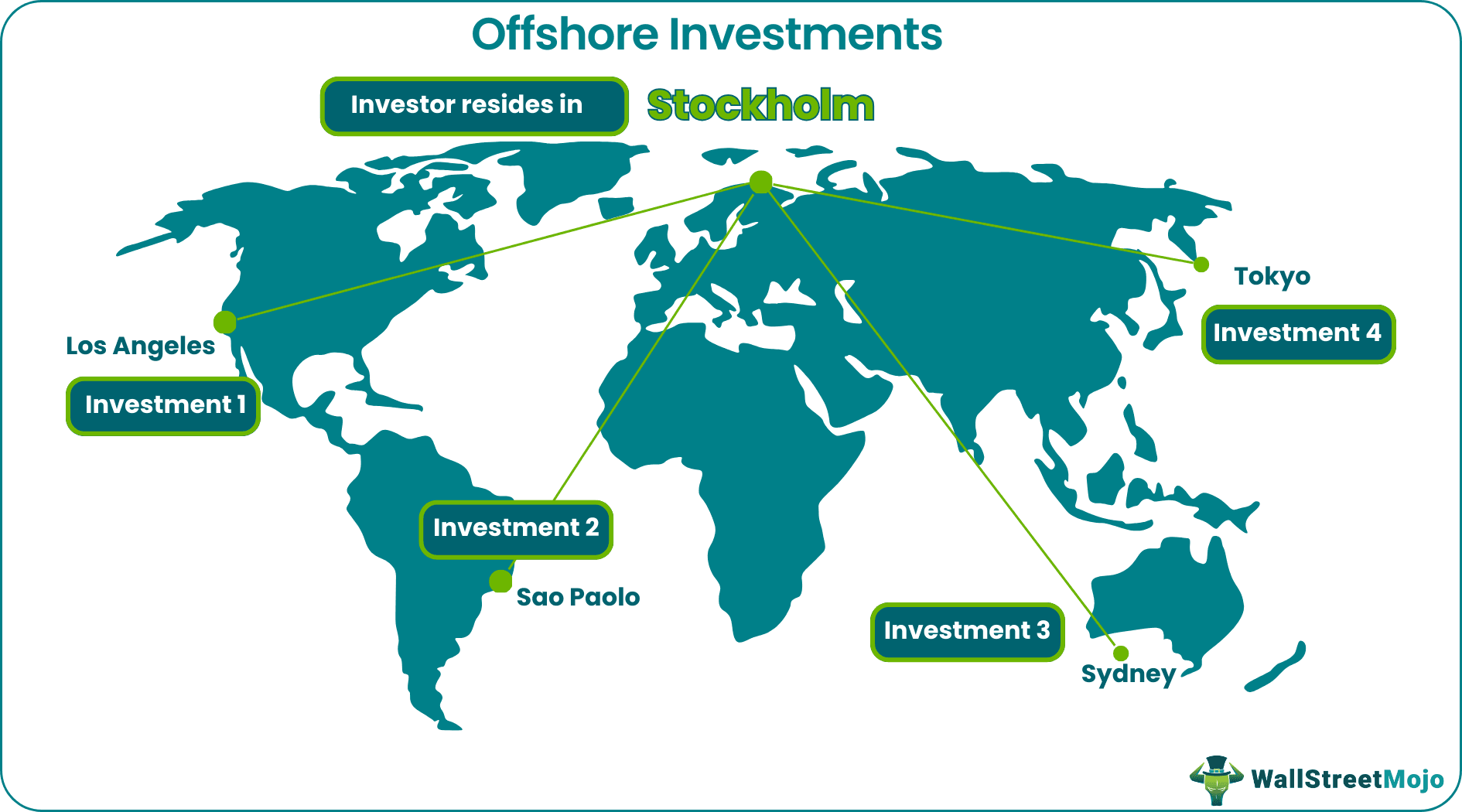

Recognizing overseas financial investment involves identifying the critical advantages it provides to individuals and companies looking for to maximize their financial portfolios. Offshore investments commonly refer to assets held in a foreign territory, typically identified by desirable tax obligation regimes, governing environments, and privacy protections. The key purpose behind such investments is to enhance capital diversity, growth, and danger management.

Financiers can access a broad range of financial instruments via offshore locations, including stocks, bonds, common funds, and property. These investments are commonly structured to adhere to regional legislations while offering flexibility in terms of asset allocation. In addition, overseas financial investment methods can enable individuals and services to hedge against domestic market volatility and geopolitical dangers.

Another secret aspect of offshore financial investment is the capacity for boosted privacy. A complete understanding of both the commitments and benefits connected with overseas investments is necessary for informed decision-making.

Benefits of Offshore Spending

Capitalists frequently transform to offshore spending for its numerous advantages, including tax performance, asset protection, and portfolio diversification. Among the key advantages is the potential for tax optimization. Several overseas jurisdictions provide positive tax routines, enabling investors to legitimately reduce their tax obligation liabilities and take full advantage of returns on their financial investments.In addition, overseas accounts can provide a layer of property security. Offshore Investment. By positioning properties in politically steady territories with strong privacy regulations, financiers can secure their wide range from prospective lawful cases, financial institutions, or economic instability in their home countries. This kind of defense is specifically interesting high-net-worth individuals and entrepreneurs encountering litigation threats

Furthermore, offshore investing facilitates profile diversification. Accessing international markets permits financiers to explore chances in different possession classes, consisting of real estate, stocks, and bonds, which may not be offered locally. This diversity can lower overall portfolio risk and boost possible returns.

Ultimately, the benefits of offshore investing are engaging for those seeking to optimize their financial methods. Nonetheless, it is crucial for financiers to completely comprehend the ramifications and guidelines linked with offshore financial investments to make sure conformity and attain their economic goals.

Picking the Right Jurisdiction

Picking the proper jurisdiction for overseas investing is a crucial choice that can considerably influence a capitalist's financial technique. The best jurisdiction can provide various advantages, consisting of positive tax obligation frameworks, property defense laws, and regulatory atmospheres that line up with a capitalist's goals.When selecting a jurisdiction, take into consideration elements such as the political security and financial health of the country, as these elements can impact financial investment safety and security and returns. The legal framework surrounding foreign financial investments should be reviewed to guarantee conformity and defense of properties. Nations understood for robust lawful systems and transparency, like Singapore or Switzerland, often impart greater confidence among capitalists.

In addition, examine the tax obligation ramifications of the jurisdiction. Some nations use appealing tax obligation incentives, while others may enforce rigid coverage needs. Comprehending these nuances can assist in enhancing tax responsibilities.

Actions to Establish an Offshore Account

Developing an overseas account involves a collection of systematic steps that make certain conformity and safety and security. The initial step is picking a respectable overseas economic institution, which ought to be certified and regulated in its territory. Conduct extensive research study to analyze the establishment's reputation, solutions used, and consumer evaluations.Following, collect the essential paperwork, which generally consists of recognition, proof of address, and information concerning the source of funds. Various jurisdictions might have differing needs, so it is essential to confirm what is needed.

Once the documents is prepared, launch the application process. This may entail loading out kinds on the internet or face to face, depending upon the establishment's procedures. Be prepared for a due persistance process where the bank will confirm your identity and examine any type of prospective risks connected with your account.

After approval, you will certainly receive look at this now your account information, enabling you to fund your offshore account. It is advisable to keep clear records of all purchases and comply with tax obligation guidelines in your home country. Establishing the account appropriately sets the structure for reliable overseas financial investment administration in the future.

Managing and Monitoring Your Investments

Once an overseas account is effectively established, the focus shifts to managing and checking your investments check this site out efficiently. This vital phase entails an organized technique to guarantee your properties line up with your financial objectives and run the risk of tolerance.Begin by developing a clear investment approach that describes your objectives, whether they are outstanding preservation, income generation, or development. Consistently examine your portfolio's efficiency against these criteria to assess whether changes are needed. Making use of monetary monitoring devices and platforms can promote real-time tracking of your financial investments, offering understandings into market patterns and asset appropriation.

Engaging with your overseas financial consultant is essential. They can provide proficiency and support, helping you browse intricate regulative atmospheres and global markets. Arrange regular testimonials to talk about efficiency, analyze click to read market conditions, and alter your approach as necessary.

Furthermore, continue to be notified regarding geopolitical growths and financial indicators that may influence your financial investments. This proactive method allows you to react promptly to altering conditions, guaranteeing your offshore profile remains robust and lined up with your investment objectives. Eventually, attentive monitoring and recurring monitoring are necessary for making the most of the benefits of your offshore investment technique.

Final Thought

To conclude, overseas financial investment uses a critical avenue for portfolio diversity and threat monitoring. By involving and choosing a proper jurisdiction with credible financial establishments, capitalists can navigate the intricacies of global markets properly. The organized method described makes certain that investors are fully equipped to optimize returns while sticking to lawful structures. Proceeded tracking and partnership with economic consultants continue to be crucial for keeping a nimble investment method in an ever-evolving international landscape.Offshore financial investment provides a structured pathway for financiers seeking to enhance their financial strategies while leveraging global opportunities.Understanding offshore investment includes identifying the critical benefits it uses to people and corporations looking for to optimize their monetary portfolios. Offshore financial investments typically refer to assets held in a foreign jurisdiction, frequently characterized by desirable tax programs, regulatory atmospheres, and personal privacy securities. In addition, offshore investment methods can make it possible for individuals and services to hedge versus residential market volatility and geopolitical dangers.

Report this wiki page